Welcome to Qingdao Prance Steel Co.,Ltd.

prancesteel@gmail.com Call Us/Whatsapp::+86 176 6090 9829

Welcome to Qingdao Prance Steel Co.,Ltd.

prancesteel@gmail.com Call Us/Whatsapp::+86 176 6090 9829

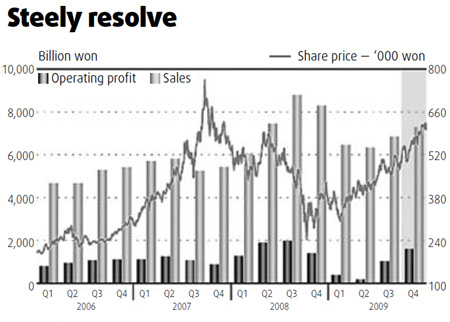

EOUL: POSCO, the world's No 4 steelmaker, plans to continue cutting costs sharply and make record-high investments to cope with a potentially long recession, it said after reporting its strongest operating profit in five quarters.

Analysts said iron ore and coking coal costs were likely to rise later this year, which they said may force POSCO to raise steel product prices in the second quarter after a shock 20-percent cut last May.

The company is yet to negotiate raw material purchase deals with its suppliers for the new fiscal year in around April.

Analysts have also warned that the unwinding of stimulus policies by governments around the world and a potentially disappointing pace of economic recovery could limit POSCO's earnings growth this year.

POSCO plans to nearly double its investment spending this year to 9.3 trillion won ($8.29 billion). It also aims to increase crude steel production by 17 percent to 34.4 million tons.

"We will pursue survival management to swiftly cope with a possible extended recession in a changing business environment and aggressive management to grab opportunities after the crisis," POSCO Chief Executive Chung Joon-yang said in a statement.

The first major Asian steelmaker to report results for the October-December quarter, POSCO posted a quarterly operating profit of 1.6 trillion won, meeting its own and analysts' forecasts, up from 1.4 trillion won a year earlier.

It benefited from a drop in iron ore and coking coal contract prices, set to continue through the second quarter of this year.

POSCO had forecast a full year operating profit of 3.2 trillion won, implying a 1.6 trillion won fourth quarter operating profit, and analysts surveyed by Thomson Reuters had forecast the same, on average.

Fourth-quarter revenue at the company, which ranks behind ArcelorMittal, Japan's Nippon Steel and China's Baosteel in world steel production, fell 12 percent to 7.3 trillion won from a year earlier.

Analysts said POSCO was expected to post firm earnings growth this quarter, helped by strong demand from the auto and electronics industries on the back of a continued global economic recovery.

They forecast that the company would post a first quarter operating profit between 1.6 trillion won and 1.8 trillion won, which would be the highest since the nearly 2 trillion won it earned in the third quarter of 2008.

Quarterly net profit rose 77 percent to 1.3 trillion won from a year earlier.

Shares in POSCO fell 0.7 percent yesterday, lagging a 0.9 percent rise in the Seoul benchmark index ahead of the result.

The stock has risen 58 percent over the past 12 months, outperforming a 41 percent rise in the benchmark KOSPI.

Reuters

Contact: Ken Zhang

Phone: +86 176 6090 9829

E-mail: prancesteel@gmail.com

Add: Economic Development District , Qingdao City, Shandong Province,China